Training Considerations for Health Economic Policy

Feature Story – By Troy Prehar

There are significant changes we should all be aware of

The election of President Joe Biden promises a return to many of the healthcare policies first put in place by the Obama administration (2008-2016). While the Trump administration certainly approached healthcare differently, it also preserved and expanded several key elements established previously.

For all of us in the LTEN community and training world, it means our customers must deal with yet more change and uncertainty. This provides a wonderful education opportunity for all of us to help our customers meet these needs.

‘Value Over Volume’

‘Value Over Volume’

The Obama administration’s biggest impact on healthcare is the focus on “value over volume.”

The passage and implementation of both the Patient Protection and Affordable Care Act (PPACA) and the Medicare Access and CHIP Reauthorization Act (MACRA) have implemented formal programs that penalize and incentivize both hospitals and providers to deliver value. The various programs contained within these two legislative actions are important for everyone in our industry to understand.

With average nonprofit hospital margins at only 1% to 3% (pre-COVID) and providers facing ever-dwindling reimbursements, the ability of industry to understand these programs and offer value propositions addressing the economic needs of our customers is paramount.

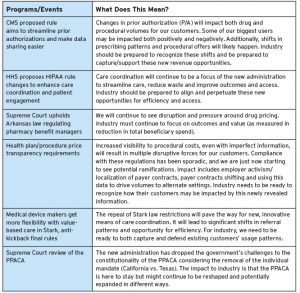

It’s beyond the scope of this article to break down these programs, but there are several suppliers in our LTEN community that offer excellent off-the-shelf training solutions. However, I would like to touch on a handful of significant changes in these and related programs we should all be aware of.

Looking Ahead

When considering these events and changes, and the post-COVID environment, successful value-selling now will require the following competencies:

- Masterful virtual selling skills (which presume masterful selling skills).

- From awareness to mastery of the business of healthcare (depends on role).

- A collaborative approach to developing value propositions, both internally and externally.

- A “consultative” mindset. Patience.

- A well-defined and integrated sales process to follow.

Our training programs must ensure they incorporate all these elements. The following questions can help align training activity accordingly:

- In light of the recent health policy updates, what opportunities exist with your solution portfolio to offer value? Or, how have your value-based solutions changed in light of recent policy changes?

- Is your company/are you prepared to help your team deliver value-based

propositions? If not, what needs to happen? - Are you looking to your healthcare economics and marketing departments as trusted advisers? Is your marketing team aware of these changes? Do you have health economics and outcomes research input and contributions to your training program?

Conclusion

Considering the skills necessary for dealing with change and our customers’ challenges can appear daunting. However, as a training community, we need to remember that all the previous sales skills and fundamentals still work for conversations relating to health economic policy needs. While our teams will need our help in learning about these programs, they don’t have to be experts to uncover our customers’ needs or present meaningful insights and solutions.

Troy Prehar is director of sales enablement and training for Philips NA. Email Troy

at troy.prehar@philips.com.